How AI is Revolutionising the Insurance Industry – And What It Means for Talent in Insurtech

Artificial Intelligence (AI) is no longer a buzzword; it’s a transformative force reshaping industries worldwide. For the insurance sector, AI represents both a challenge and an unparalleled opportunity. From streamlining operations to enhancing customer experiences, the integration of AI is driving efficiency and innovation at an unprecedented scale. As we stand on the brink of this AI-driven evolution, the demand for skilled talent in insurtech is at an all-time high.

In this blog, I’ll explore the profound impact AI is having on the insurance industry, the opportunities it presents, and why building a workforce with AI expertise is critical for staying competitive.

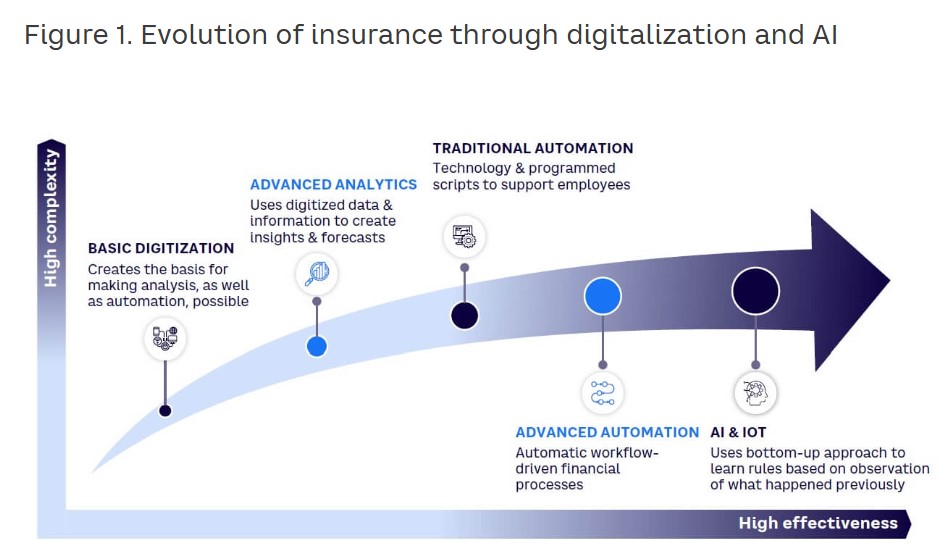

The Growing Role of AI in Insurance

AI is making waves in the insurance industry by automating processes, analyzing vast datasets, and offering predictive insights that were previously unimaginable. According to a McKinsey report, insurers leveraging AI have seen up to a 30% reduction in claim processing times and significant cost savings across various operations.

Here are a few key areas where AI is making an impact:

Fraud Detection: AI algorithms are analysing patterns in claims data to identify and flag potential fraudulent activities, saving insurers billions annually.

Claims Processing: AI-powered systems can assess damages, process claims, and even disburse payments within hours, significantly improving customer satisfaction.

Risk Assessment and Underwriting: AI is transforming underwriting by evaluating risks using real-time data from IoT devices, social media, and other sources.

Personalized Customer Experiences: Chatbots and virtual assistants powered by AI are enhancing customer interactions by providing instant, accurate responses and tailored recommendations.

Predictive Analytics: AI models predict trends and potential risks, enabling insurers to proactively manage portfolios and pricing strategies.

For insurers, adopting AI is not just about staying ahead; it’s about survival in an increasingly competitive market.

Opportunities for Insurtech Firms

Insurtech companies are at the forefront of AI adoption, driving innovation and creating solutions that are redefining the insurance landscape. The opportunities AI offers to these firms include:

Scalable Solutions: AI enables insurtech firms to develop scalable platforms that cater to diverse markets and geographies.

New Product Development: AI is facilitating the creation of innovative insurance products, such as on-demand and usage-based policies.

Cost Reduction: By automating repetitive tasks, AI helps insurtech companies reduce operational costs while maintaining high service levels.

Data-Driven Insights: Advanced analytics tools powered by AI provide actionable insights for insurers to optimize performance and improve decision-making.

Why AI Talent is the Game-Changer

As AI continues to revolutionize the insurance industry, the need for talent with AI expertise has become critical. Insurers and insurtech firms require professionals who can:

- Develop AI Models: Build and fine-tune machine learning models for fraud detection, risk assessment, and more.

- Analyze Complex Data: Use AI tools to extract insights from vast datasets, driving smarter business decisions.

- Implement AI Solutions: Work with cross-functional teams to integrate AI technologies seamlessly into existing systems.

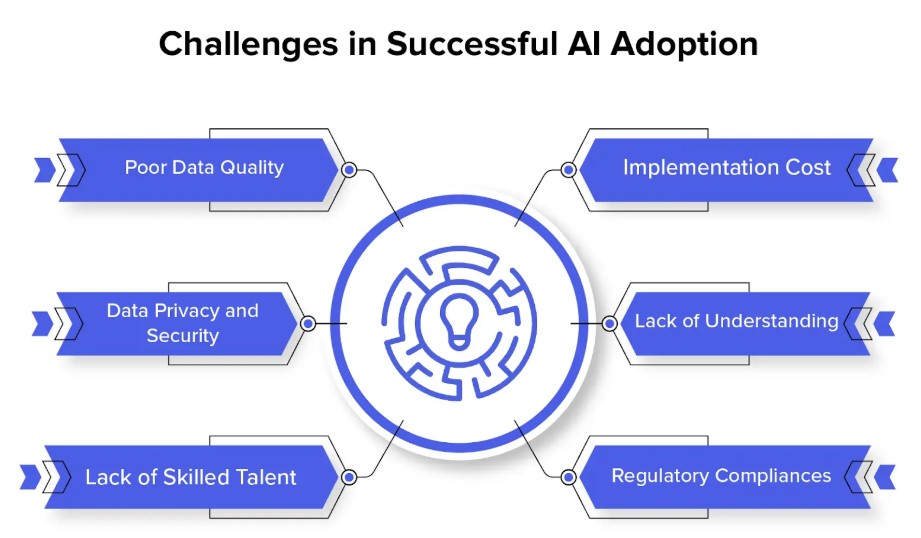

- Navigate Ethical Considerations: Address issues such as data privacy, bias in algorithms, and regulatory compliance.

For recruiters in the insurtech space, this presents an exciting opportunity to connect firms with top-tier AI talent. However, finding candidates with the right blend of technical expertise, industry knowledge, and soft skills can be challenging.

Building an AI-Ready Talent Pool

As recruiters, we’re committed to identifying and nurturing a "future-ready" talent pool to meet the growing demand for AI expertise in insurance. This means:

- Expanding Candidate Networks: Seeking talent from diverse fields such as data science, software engineering, and actuarial sciences.

- Prioritizing Continuous Learning: Encouraging candidates to pursue certifications and training in AI and machine learning.

- Fostering Cross-Disciplinary Skills: Recognizing the value of professionals who can bridge the gap between technology and business.

By building a strong network of AI-skilled professionals, we can help insurers and insurtech firms thrive in this new era of digital transformation.

What Can Insurers and Insurtech Firms Do to Attract AI Talent?

To attract and retain AI talent, companies should:

Emphasise Innovation: Showcase the cutting-edge projects and technologies that candidates will work on.

Invest in Development: Offer opportunities for upskilling and career growth through training programs and mentorship.

Create Inclusive Workplaces: Build environments where diverse perspectives are valued and collaboration is encouraged.

The Future of Insurance is AI-Driven

AI is not just a tool; it’s a catalyst for change in the insurance industry. Insurers and insurtech firms that embrace AI will not only improve their operations but also deliver better outcomes for their customers.

For recruiters like myself, the mission is clear: to build the teams that will drive this transformation. By connecting insurers with professionals who have the skills and vision to harness the power of AI, we can help shape a smarter, more resilient industry.

As we look to the future, one thing is certain: the future of insurance is AI-driven, and it’s powered by the people who make it possible.